” Command them to do good, to be rich in good deeds, and to be generous and willing to share.” – 1 Timothy 6:18

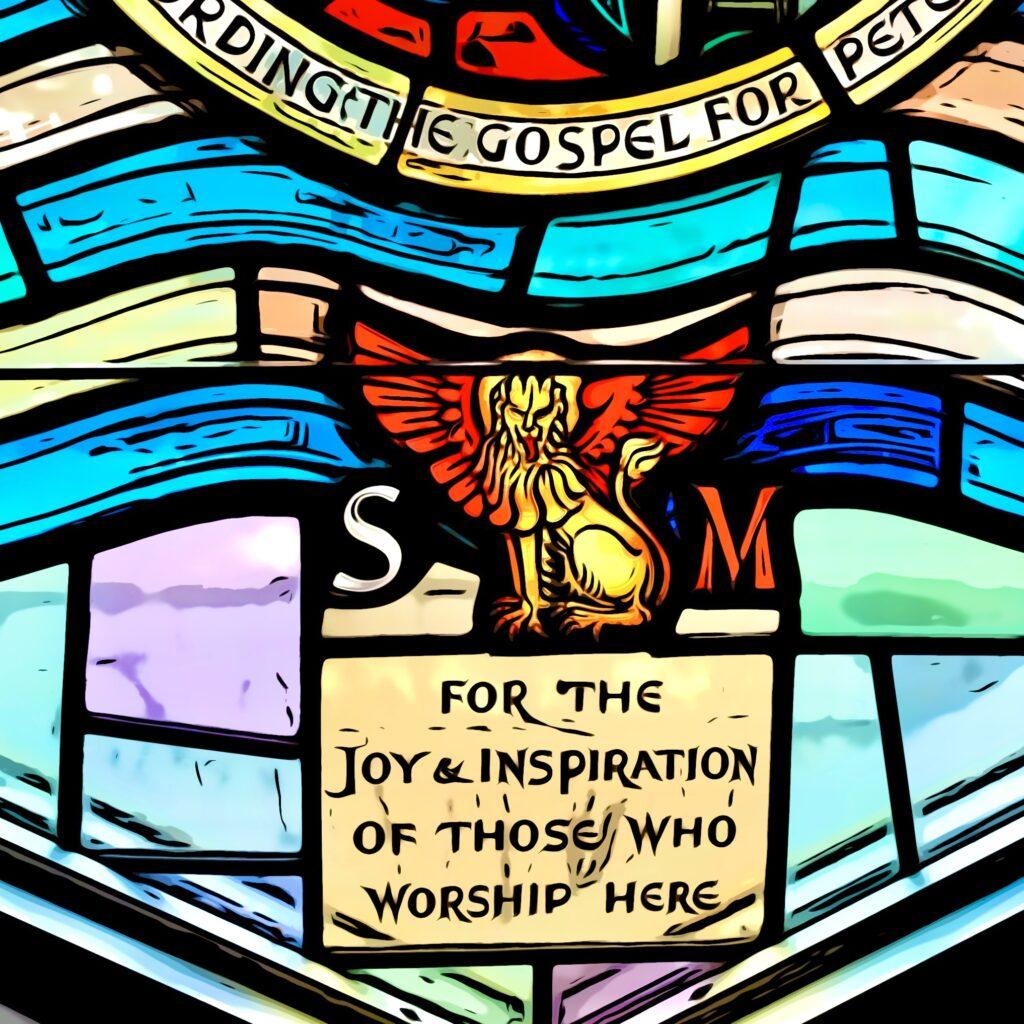

This year marks St Mark’s 70th anniversary. 70 years of being a community of believers dedicated to God’s service in our community. The Christian Generosity committee has historically reminded us about how we give through our time, talent and treasure. Throughout the year we hope to again highlight the many ways we answer God’s call to be a generous people. We are going to look back at our roots throughout the year to see who we were and who we’ve become. We hope to highlight those things for which we give gratitude and thanks to God and hopefully hold a reunion event to celebrate our 70 years.

Donating To St. Mark’s

The Christian Generosity team would like to remind everyone that there are many ways to support St. Mark’s ministries financially. You are now able to give through e-transfer directly from your bank and you can set this up to be automatic each month (more information here). If you prefer, pre-authorized debit (PAD) is available and all you have to do is fill in the PAD form which can be found on our website. If you already do PAD and wish to update your donation, this does not require you to fill in any forms. All you need to do is contact the envelope secretaries by emailing them with your change using the form at the bottom of the post.

It is Tax Season! Read all about the Donation Tax Credit…

In general, the first $200 of charitable donations claimed on our tax returns will bring about a 15% federal tax credit, and donations above that amount will bring about a 29% federal tax credit. The comparable Ontario tax credit adds 5.05% and 11.16% respectively. That means the combined Donation Tax Credits are about 20% for the first $200 of donations claimed and 40% for the rest.

Donation tax credits are “non-refundable” meaning they can reduce tax payable but don’t generate a refund where there is no tax to offset.

Donation Tax Credits, calculated on donations to St. Mark’s and others, are a silver lining in that dark cloud of having to prepare our Income Tax Returns! These credits can help us support the financing of more good works through St Mark’s for 2023.

Our goal is a 5% increase in envelope donations for 2023, for parishioners who can do that, to help reduce our increased costs.